The more money you initially put down on a car, the lower your loan amount and monthly payments. Credit score requirements will vary by lender, but if your credit score is on the lower end, you may want to spend some time working to improve your credit to ensure you get the best interest rate for you. The lower your score, the higher your interest rate is likely to be for the loan. Factors to Consider Before Taking Out a Car LoanĪfter determining how much you can spend on a new vehicle to ensure a comfortable monthly payment, you may want to consider these additional factors before applying for an auto loan:

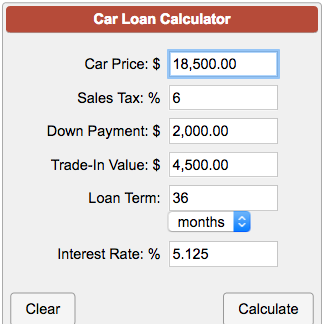

With this number in hand, and assuming the result is within your budget comfort zone, you can go ahead with confidence knowing you can afford the monthly payments. You can find interest rates for auto loans through Desert Financial on our rates page.Īs soon as you’ve provided your information, the calculator will automatically bring up your total estimated monthly payment amount based upon those values. Before selecting an interest rate on our auto loan calculator, it’s a good idea to check with your lender to see what the current auto loan interest rates are for new or used vehicles. The interest rate you receive on your auto loan depends on various factors such as your credit score, loan term, model year and the loan-to-value of the vehicle you are purchasing. The interest rate is the price you pay for the privilege of borrowing money from your lender. The longer your term, the lower your overall monthly payment will be, but you’ll pay more in interest over the life of the loan. Car loans have a broad range of terms, with the most popular loan terms at 60 and 72 months. This refers to the number of months you’ll have to repay your car loan. This isn’t the total cost of the car, so be sure to take that into consideration when determining what kind of car you can afford. Your auto loan amount refers to the amount you’ll borrow after your down payment and/or trade-in amount. To calculate your estimated monthly car payment using our auto loan calculator, follow these three simple steps:

MONRHLY PAYMENT CAR LOAN CALC HOW TO

How to Calculate Your Monthly Auto Loan Amount

0 kommentar(er)

0 kommentar(er)